CANMORE – Property owners and builders in Canmore have a brand new off-site levy bylaw to work with when proposing new development in the community.

Canmore council voted on Jan. 5 to give second and third reading to the bylaw, which sets out to ensure growth pays for growth as development and redevelopment in the community proceeds.

Asset management coordinator Pete Kinsberg presented the updated bylaw to council in December for first reading. He said the purpose of off-site levies is to create a legislated method of repayment by the development community for costs incurred by the municipality to provide infrastructure that benefits future development.

"It is really to ensure that infrastructure costs are fairly allocated to new development and growth in our community," Kinsberg said. "We have to remember that the Town of Canmore often has to pay for growth-related infrastructure projects much earlier than when development occurs."

Off-site levies are legislated under the Municipal Government Act (MGA) and can only be applied in specific situations where projects will benefit future growth in the community. Kinsberg said these projects often also benefit existing residents, so it is important to have a bylaw that establishes what percentage of a project's cost is truly attributable to that growth.

"Once we have that dollar amount, it is simply a matter of dividing that dollar amount by the number of future development units," he said. "That results, ultimately, is a ratio that is the off-site levy rate."

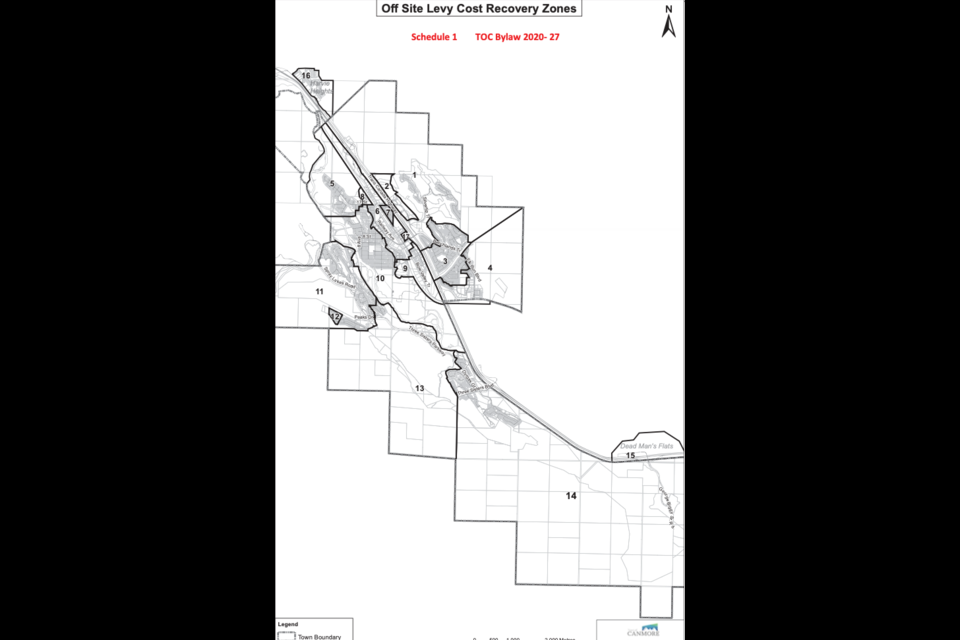

The bylaw divides Canmore into 17 off-site levy recovery zones. Each zone has a number of units that are planned for future development, including redevelopment and infill scenarios. The bylaw uses a 25-year rolling timeframe for calculating the rates and considers residential, hotel and commercial development categories.

The types of projects that off-site levies can be applied to is restricted. It includes transportation, water, sewer, stormwater, and fire protection projects. Kinsberg said there are 75 future projects that fit into those categories with a total estimated construction cost of $145 million.

That includes the upgrades to Bow Valley Trail and Railway Avenue; upgrades to the wastewater treatment plant; steep creek mitigations for Stoneworks Creek; stormwater upgrades for Teepee Town; and two new fire halls.

The model used attributes 60 per cent of that cost to growth, or $85 million. So far, $25 million in off-site levies have already been collected and $60 million is remaining to be paid by developers.

Kinsberg said that if development plans in the community change, the model also needs to be revised so the rates remain fair and up to date.

The municipality used a model developed by a third party – Corvus Consulting. Corvus's model is used by 35 other municipalities; however, administration independently validated the model.

Bow Valley Builders and Developers participated in the 18 month review of the model used to calculate the levy rates and corresponding bylaw. In a letter to council, executive director Ron Remple said the work done to test and verify the accuracy and integrity of the model was appreciated.

Remple also took note of changes to the model, which included the introduction of service demand factors and an increased planning timeframe of 25 years.

"BOWDA's focus throughout the review of the [off-site levy model] has been ensuring that the [model] is consistent with the Municipal Government Act section 648 and off-site levies regulation," wrote Remple.

"BOWDA and Town administration have worked to ensure that the benefiting areas and per cent attributable to growth for each project are clearly identified to ensure the [off-site levy model] is MGA compliant."

Councillor Joanna McCallum said she appreciated the level of detail used to make the calculations.

"This bylaw is a really important part of our asset management, as well as project budgeting for the community," McCallum said.

"It really does ensure that growth pays for growth in our community and that current taxpayers are not on the hook for future growth that happens in our community."